The smart Trick of 11 Ways I Paid Off $80,000 Of Debt---in Just 3 Years That Nobody is Talking About

That added time will certainly cost you more in rate of interest costs. While the debt snowball as well as avalanche are 2 overarching approaches for how to settle financial debt, right here are some certain strategies you can use in conjunction with them. When you have bank card financial obligation, one choice is to move your bank card balance to a various card.

This resembles paying off one charge card using another card. A lower-rate equilibrium transfer card can fit well with the avalanche approach. Considering that you can utilize a balance transfer to strategically reduce the passion price on your highest-interest financial obligation, it can get you time to concentrate on the next-highest rate of interest account.

Many equilibrium transfer charge card also use a 0% APR for an introductory period (often 6-18 months). A 0% APR deal enables you a chance to repay your bank card equilibrium without sustaining additional interest fees. State you have $6,000 of charge card debt at an 18% APR. You might move that equilibrium to a card that offers a 0% APR for twelve month.

You'll most likely have to pay a equilibrium transfer charge, so be sure to run the numbers as well as read the small print up front. However a few debt cards provide 0% APR balance transfers as well as charge no equilibrium transfer fees. If you have at the very least respectable credit history, you might be able to get a good equilibrium transfer offer.

All About Pay Off Your Debt: Tools And Tips - Nerdwallet

Repaying bank card financial obligation outright is typically the smartest financial strategy. Yet, if you're in a lot bank card financial obligation that you can't manage to merely compose a huge check and also the financial debt avalanche approach appears as well overwhelming or slow to take care of, it could be time to think about an alternate method.

The benefits of this route include: Because a personal finance is an installment loan, its balance-to-limit proportion doesn't injure your credit score the way revolving accounts (like charge card) might. So, repaying your charge card financial obligation with an installment car loan could significantly increase your credit history, specifically if you do not currently have any kind of installment fundings on your credit reports.

Personal loan rates of interest are typically less than charge card interest prices. If you qualify for an installation lending with a reduced rate, you'll wind up paying much less money on the whole. That being said, obtaining a car loan to repay charge card debt can likewise be harmful. Follow the terms of the lending very carefully, or you could just make your circumstance worse.

Or else, you might finish up further in the red. If you utilize this approach, keep in mind these essential points: Do not shut the bank card you settle, unless they have annual costs you don't wish to pay. Keep them open to aid your debt use. Do not spend anymore cash on your paid-off charge card.

The 20-Second Trick For Should I Pay Off Debt Or Invest Extra Cash? - Investopedia

Make normal, prompt payments on your installment finance. If you don't, you'll simply develop more issues for your credit rating - Get out of debt. There are many places to try to find personal loans with a wide array of prices depending upon the loan provider as well as your credit report. You might intend to contact local financial institutions and lending institution where you already have an account.

A personal funding can impact your credit report in numerous means. Whether the account ultimately hurts or helps you depends upon 2 key elements exactly how you handle the account et cetera of the information on your credit history reports. The application may harm your ratings. When you get credit score, a questions is contributed to your credit score records.

Your scores might enhance as your individual loan ages. Initially, a new account may lower your typical age of credit history as well as adversely affect your ratings. As your personal funding ages, it might aid those numbers. An individual car loan might lower your credit score use. Individual fundings are installment financings, which don't impact your rotating usage proportion whatsoever.

If you pay off debt cards with an individual financing, your rotating use proportion need to decrease, as well as your ratings might boost. Your credit history combination could improve with a personal financing. Rating designs reward you for having a diverse mixture of accounts on your credit score records. If you do not have any type of installation lendings on your records, including an individual finance could assist your scores.

The Ultimate Guide To Best Way To Pay Off Debt - Credit Karma

Just make sure you make every settlement in a timely manner. If you open an individual financing as well as pay it late, it could harm your scores significantly. Program moreShow less Financial debt negotiation is another alternative you can consider when you prepare to eliminate your charge card debt. This method typically functions finest for individuals who (a) are currently past-due on their bank card payments as well as (b) can afford to make big, single settlement payments to their financial institutions.

You could be qualified if you have actually gone through difficulties like job loss, clinical troubles, or separation. Nevertheless, some financial institutions will think about settling financial obligations also if you don't have any type of unique extenuating circumstances. You may, nevertheless, need to pay tax obligations on the forgiven amount. You can clear up financial debts by yourself or you can employ a specialist debt settlement firm to handle the process for you.

Discover what to look out for at the FTC Consumer Information web site. When you have actually reached your restrictions and have nowhere else to turn, insolvency can use a new beginning. You should only use it as a last resource, nonetheless, due to the fact that bankruptcy can devastate your credit report. There are 2 kinds of personal bankruptcy:, which usually requires you to surrender a few of your property, which permits you to maintain your building Proclaiming either sort of personal bankruptcy can be a long, pricey procedure consisting of lawyer as well as court declaring charges as well as you should not take it lightly.

When you're swimming in red-letter bills and harassing phone telephone calls, it can usually seem like there's no other way out. Yet by utilizing the approaches over, you can ultimately totally free yourself from the irons of financial debt.

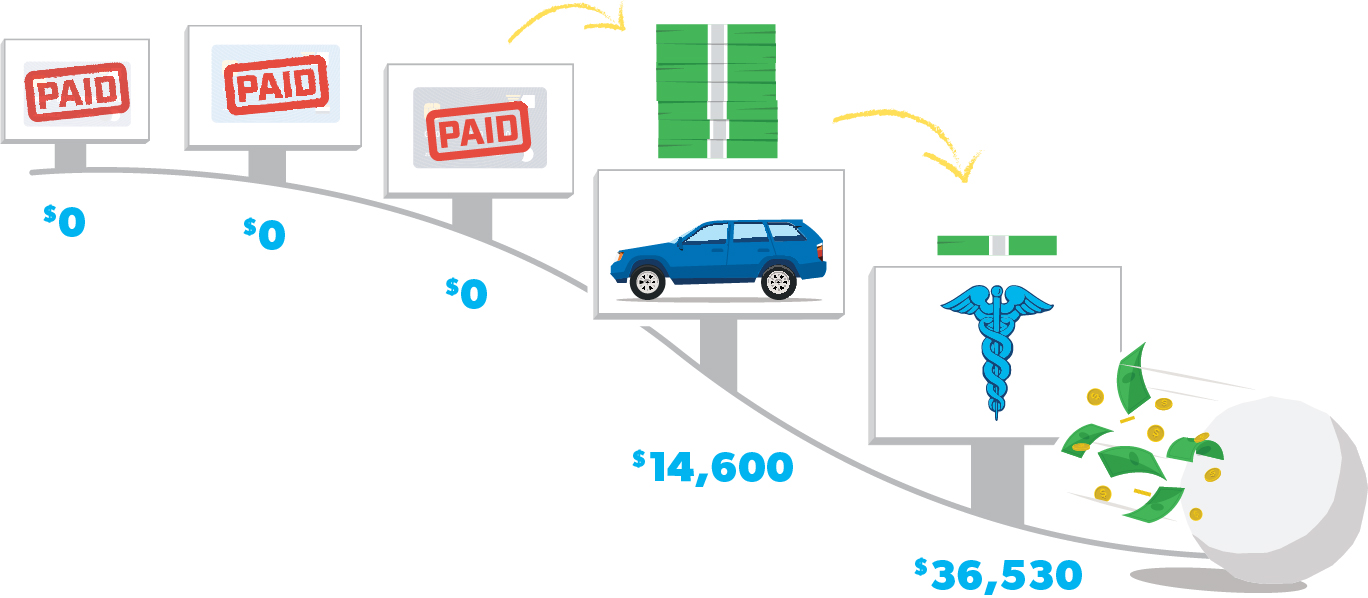

The Ultimate Guide To How To Pay Off Debt - Daveramsey.com

Make use of these devices to get your debt-free date and also locate a benefit path. Then, join NerdWallet to track your financial debts as well as see upcoming repayments.

If you owe money on student lendings, car loans and credit report card bills, you're not the only one. The current numbers from the Federal Book show that the complete national household debt stands at $13.54 trillion.(1) That's trillion with a "T. Debt relief." And also based on those numbers, it's safe to state that stressing regarding financial debt is a nationwide epidemic.

Financial obligation is as American as apple pie, however you understand as well as we do that it does not taste as pleasant. If you stick to us, we'll show you just how to repay financial obligation and stay out of financial obligation completely. Anything owed to somebody else is taken into consideration debtyep, that also includes pupil fundings as well as cars and truck finances.

Those are simply variable month-to-month expenses. The very same goes with things like insurance, tax obligations, grocery stores as well as child care expenses. Non-mortgage financial debt includes: student lendings vehicle fundings charge card clinical financial debt house equity fundings payday advances personal finances Internal Revenue Service and national debt Currently, just how you pay for these expenditures can develop into financial obligation.

debt relief company